Businesses across the world ought to watch out for Matthew Quigley of Zenith Partners, based in Poland, after taking ‘administration fees’ for business funding and never providing the funds.

Seemingly Quigley is not only defrauding businesses, but also solicitors acting in the transactions.

NOTE: this is only half of the information, more information can be found by CLICKING HERE.

Who is Matthew Quigley?

The answer to that is, in short, that he is not Matthew Quigley!

Matthew Quigley was born Matthew Curran on 15 August 1971. For some reason best known to himself, he changed names by Deed Poll from Matthew Curran to Matthew Quigley. Despite this, he uses the months of July and August of 1971 in Companies House filings.

In March 2007 an unemployed Matthew James Quigley was bankrupted……

Oddly, just 4 months later in July 2007, someone called Matthew Anthony Curran was also bankrupted……. could this be the same guy?

Just a few years later in 2014, Matthew Quigley was featured on a BBC program called Inside Out. Two years later the BBC News ran an article on him concerning the ambulance company which went bust.

This blog has uncovered a total of 39 companies in the UK set up by Matthew Quigley which have been dissolved and/or gone into insolvency. To date, he appears to be director of another 8 companies.

Under the name of Matthew Curran, he has set up a total of 13 companies, all of which have been dissolved.

Seemingly, Quigley went on to become a quasi finance broker, offering ‘solutions’ such as invoice finance…… however, Matthew Quigley does not hold any form of authorisation by the Financial Conduct Authority to do so – and ostensibly this is regulated activity. Potentially this is a criminal offence.

In December 2017 Quigley set up various companies under the name of Zenith.

At some point, Matthew Quigley exiled himself to Poland setting up Zenith Partners Spolka Z o o.

Aside from Matthew Quigley’s boyish good looks, he also has a glass eye!

Zenith Partners Fraud

The Zenith Partners fraud is relatively straightforward, but for the reasons explained below substantiated by fraud and legitimized by solicitors.

The Claims

Quigley claims to have various ‘Funds’. These are said to be in a range of places including Poland, Luxembourg and America. He claims that the wealthy Polish Jurczyk family have invested in his fund. He also claims that the Polish fund is registered with the Polish KNF.

With these bold statements he claims to be able to offer business financing, usually in the form of a Convertible Loan Note, or other type of financial instrument.

For arranging said funding, Quigley seeks an administration fee in advance… Usually this is somewhere around the £5,000 mark. However some businesses have reported as low as £1,250, and others towards the £10,000 mark.

Then Quigley will introduce the business to a firm of solicitors for the purpose of legal paperwork. Sometimes the firms are Polish, but often UK-based.

During this process Quigley and Zenith string out the process. Claim after claim is made and deadline after deadline missed.

Sometimes it gets no further than that, with businesses becoming annoyed and terminating the transactions. At other times, the legal agreements are counter-signed, but no funds are ever received.

When the transaction is terminated because of lack of funds and/or legal paperwork – Matthew Quigley claims to return the administration fee(s). In reality, he never does.

The Reality

Quigley claims these funds have regulatory approval – but in reality they do not. There is nothing whatsoever on the KNF to suggest that this is a registered fund, when searching the reference Quigley has provided.

The Jurczyk family have explicitly said they want nothing to do with him because they don’t trust him. A solicitors letter seen by this blog confirmed that:

It was confirmed by [name removed] after speaking with Sebastian Jurczyk that the family in question had never agreed to provide capital funding and had never deposited any money in any bank account [of Quigley/Zenith] and had no intention of doing so.

And

….IBB Media also spoke to Martyna Jurczyk who again confirmed that the family had not and did not intend to invest in Zenith.

In some cases Quigley uses falsified bank statements (more on this below) to attempt to prove Zenith had refunded administration fees. Unfortunately, the bank statement was sent to an IT expert who confirmed that the PDF had been falsified through its Metadata.

Zenith and Matthew Quigley De-Banked by ING

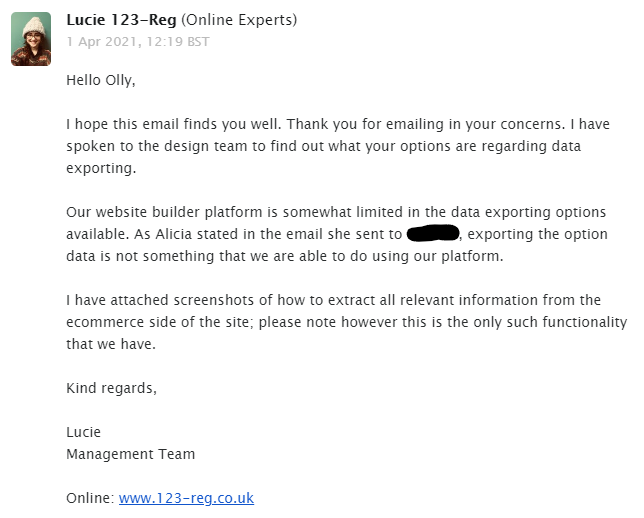

A key factor of the Zenith Partners fraud is the proof of funds. Businesses expecting funds and solicitors alike have been demanding proof of funds from Quigley.

In attempt to demonstrate proof of funds, Quigley provided this bank statement claiming to show 205,567,850.00pln in the bank…… This in £GBP, is just over £40M.

This however is a complete fabrication and falsification of documents.

In an internal email seen by this Blog, a representative of ING says (Polish translated):

In my humble opinion, the attached document is a forgery. The funds shown there are out of this world. I don’t know if [Zenith] shouldn’t be kept on some list because of this forgery.

More concerning is an email from another colleague at ING who says (Polish translated):

yes, it is fake, at the time indicated on the document the account balance was PLN 10.39.

10.39PLN, is about £2.04! Not quite the £40M claimed!!

Fortunately, the good people of ING’s Polish branch don’t mess about, and wrote the following (Polish translated):

Please exit the relationship with the client kkf 2211738166. The client is trying to deceive his contractors with false confirmations. Exiting the relationship on the basis of the Regulations on opening and maintaining bank accounts at ING Bank Śląski S.A. § 16.5.7 we will not be able to perform the obligations under the application of financial security measures, which are specified in the Act on Counteracting Money Laundering and Terrorism Financing.

And with that Matthew Quigley and Zenith Partners were de-banked by ING for fraud!

This of course wasn’t for long. Quigley has since set up accounts with Poland’s Bank Pekao under Zenith’s name. However, as explained above, Quigley provided other false bank statements claiming to have refunded administration fees. Bank Pekao are now investigating.

Legitimized by Solicitors?

One of the key factors about fraud is solicitors acting for clients are supposed to conduct anti-fraud and anti-money laundering checks. Before acting for any client they need to be entirely satisfied that their client is not doing anything they shouldn’t be doing.

Matthew Quigley seems to have done the rounds with solicitors. Reportedly, he is in debt to the tune of over £300,000 to various law firms. This includes large and well respected firms such as Shoosmiths, McCarthy Denning and HCR Law. Quigley has also got his talons into other smaller boutique law firms.

In March of 2024, Zenith’s external solicitor Dr Saverio Salandra from HCR Law requested a series of documents, seemingly to do proper backgrounds checks into Zenith and Matthew Quigley.

By May 2024 matters came to a head when HCR were instructed to threaten two individuals who were contracted by Zenith as consultants. These individuals believed what Quigley told them was true, and when they found out the truth concerning the falsified documents and the Jurczyk family, they refused to continue to be associated with Quigley.

This resulted in an angry letter from HCR Law, a series of attempted undertakings and demands for disclosure and delivery up of documents. The letters themselves have the hallmarks of a SLAPP. On the face of it, the letters were probably written by Quigley himself and adjusted by HCR, as they contain words that solicitors tend not to use such as “nonsense”, which is a word Quigley uses to describe anything that exposes the truth about him.

In June 2024, the letter was responded to by top law firm Anthony Gold Solicitors. The general contents of the response is irrelevant (despite being very well written), apart from one specific issue: twice in the letter HCR Law were informed there was an ongoing criminal investigation into Matthew Quigley and Zenith. Other parts of the Anthony Gold letter referred to things which were “untrue”, “falsified” or done “fraudulently”.

Solicitors don’t use the words “untrue”, “falsified” or “fraudulently” without good reason to, and in this case Anthony Gold were right to…. The fact that Anthony Gold were prepared to use these words should have rang alarm bells with HCR Law, notwithstanding HCR were informed of an active criminal investigation.

Quite obviously, when HCR Law became aware of a criminal investigation and the allegations by Anthony Gold they had a duty to, in the very least, investigate and undertake further checks into their client.

This plainly did not happen. The letter from Anthony Gold was dated June 2024 – yet in August and September 2024, Dr Saverio Salandra was still acting for Zenith Partners and Matthew Quigley.

The issues of fraud have now been firmly re-stated to HCR in September 2024, including their Risk Management Partner Lesley-Ann Hamlyn. If HCR continue to act for Matthew Quigley and Zenith Partners there are clear regulatory issues which need bringing to the attention of the Solicitors Regulatory Authority – they have had 3 clear warnings; in March 2024, June 2024 and now September 2024.

Dr Saverio Salandra is now the subject of an official complaint to HCR Law, and pending the result of that will be subject to a complaint to the Solicitors Regulatory Authority.

The Fake Awards!

Perhaps an amusing part to this sorry state of affairs is it seems that Matthew Quigley has been scammed by the scammers!

A few months ago my friend wrote about AI Global Media and their scam of harvesting email addresses and handing out fake awards. It seems that one of their victims is none less than Matthew Quigley and Zenith Partners themselves!

Apparently, Zenith Partners won the “Most Approachable & Agile Global Investment Partner 2021” in the Worldwide Finance Awards 2021…. It seems Quigley was even conned into paying for the certificate – although in reality, AI Global Media have probably never been paid either.

Matthew Quigley is Pathetic

Over time, this Blog has exposed some interesting fraudsters. Many of the fraudsters have done very well out of their crimes, resulting in owning companies turning over 100’s of millions, or owning football clubs, or driving nice cars and living in big houses – and they say crime doesn’t pay!

Fraudster Matthew Quigley is however a different kettle of fish….. The lies he tells are elaborate, the misuse of solicitors to make the contracts look legitimate clever, the extents he goes to falsify bank statements impressive (albeit flawed).

However, the reality is that Matthew Quigley is so pathetic he’s incapable of even committing fraud to the degree of having anything to show for it. He’s knocking businesses for £1,200 here and £5,000 there and running up large solicitors bills in the process. He reportedly lives in a small apartment in Poland. He apparently drives a leased Audi A5 and his wife drives a BMW 1 Series. When he flew to San Francisco for a business meeting he flew in Economy.

He’s hardly living a lavish lifestyle – in fact you may even say he lives relatively frugally for a self-claimed financier managing a £50M to £150M (depending who you ask) fund. The truth is he’s simply a sad and pathetic under-achiever, who defrauds people at the lowest level possible. You couldn’t even trust the guy with a £5 note.

Conclusion

Matthew Quigley (as he calls himself today) of Zenith Partners, seemingly residing in Poland is not someone to be trusted whatsoever.

- DO NOT pay him any money up front, you won’t get it back.

- DO NOT trust a word he says, it’s all lies.

Not only is Matthew Quigley a fraudster, but he is so sad and pathetic the actual fraud he conducts he has clearly barely made any money from. Now he’s in big trouble. Lots UK businesses are after him, demanding their money back. Solicitors firms in the UK and Poland are demanding their money. He’s been de-banked by ING. Peakao bank are concerned about him. The UK and Polish criminal authorities are investigating him.

Rumour has it that he has plans to flee to the US…..but you need a Visa to live and work in the US, and the Homeland Security will undertake searches of Matthew James Quigley – including Google searches…. I do hope they are reading this!

You heard it here first: steer well clear of Matthew James Quigley of Zenith Partners.